RESOURCES

Useful Articlesand Resources

What is a Backdoor Roth Conversion?

By Childfree Wealth® team | Nov 7, 2022

Most terms in the world of personal finance muddy the waters far more than they provide clarification. One of these terms is the Backdoor Roth Conversion which is often confused with the simpler Roth Conversion. Both can be useful strategies depending on your situation, but backdoor Roth conversions are a little bit more complex due to the potential […]

Read More

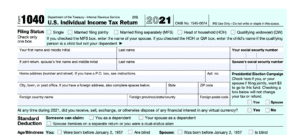

If I’m Married, Should I Always File Taxes Jointly?

By Childfree Wealth® team | Oct 10, 2022

There is a general understanding that getting married (beyond all the obvious reasons for getting married) often helps with your tax situation. Tax deductions, increased tax brackets, and other perks often make it worthwhile. I would feel comfortable saying it USUALLY makes financial sense to go ahead and tie the knot, but here are a couple of reasons you […]

Read More

Make Your Charitable Giving More Intentional

By Childfree Wealth® team | Sep 19, 2022

Giving to charity is something many of us feel like we could (and should) do more of. It’s often at the end of the year when there is a big push for giving that prompts us to obligatorily write a check. We’re so busy with holiday plans that we haphazardly give money (which still helps!), […]

Read More

Creating Successful Small Businesses and Side-Gigs

By Jay Zigmont | Aug 28, 2022

With today’s hustle culture combined with a search for meaning, many people are following their dreams to start a small business. Being Childfree often allows us the time, money, and freedom to stretch and see what is possible. If you decide to start a small business or other side-gig, you need to make a series of […]

Read More

Understanding Taxes and Being Childfree

By Jay Zigmont | Feb 28, 2022

Once a year, people do their taxes and either complain about what they owe or are excited about their refund. At the same time, on social media, people brag or complain about what tax ‘breaks’ they have. As Childfree individuals, we will not qualify for any of the child tax or family credits, but we […]

Read More