The First Planning Firm for People Without Kids

Simplify your finances and let your amazing Childfree life unfold.

Featured In:

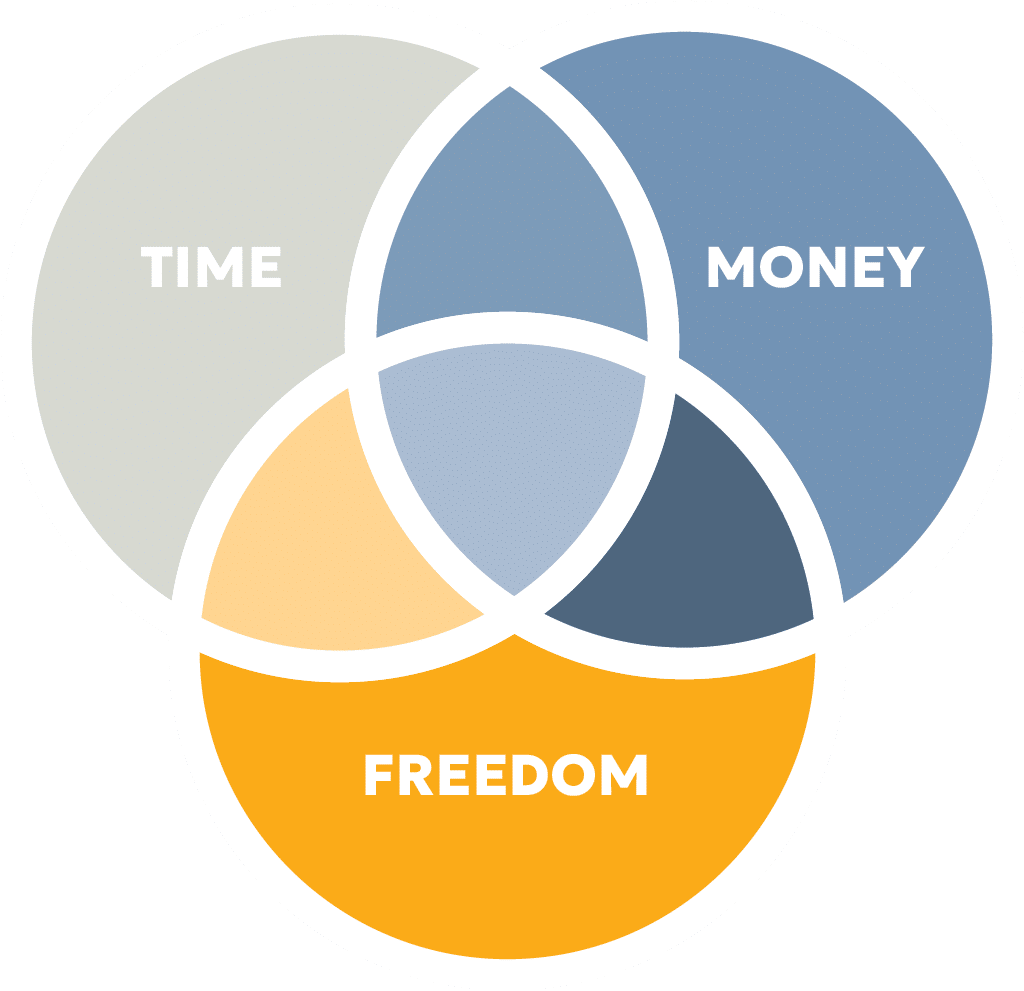

Life Without Kids Is Different.

Most people don’t understand what Childfree life is like, including financial planners.

Traditional financial planners follow a predictable life script. But the movie is so much better when you write it yourself.

When you’re Childfree, anything is possible! It’s time to give your life the starring role, and make money your supporting cast.

Do What You Love

Pursue passion projects. Make work optional. Travel or live abroad. It’s your life!

Make an Impact

Leave your mark on the world — without a genetic legacy.

Plan for Future Care

Set aside money and create a plan that will support you as you age.

START HERE

Childfree Wealth Checkup

Every client relationship begins with a Childfree Wealth Checkup with one of our Childfree Wealth Specialists®, all of whom are CERTIFIED FINANCIAL PLANNERS®.

Together, we’ll look at your finances through a Childfree lens, and you’ll walk away with the beginnings of a plan to make unconventional choices for your amazing Childfree life.

Beyond Your Checkup: Get Support for Your Plan

FOCUSED ON FINANCES

Childfree Wealth 180

Regular financial check-ins with light life-planning support

ROBUST AND COMPREHENSIVE

Childfree Wealth 360

White-glove support to simplify your finances for your amazing Childfree life

Our Promise: We Work for You.

Flat-Fee

No matter your net worth, you pay an annual fee for our services — so there are no surprises.

Fee-only

We don’t make commissions on products or transactions — you’re the only one paying us, so we work for you.

Fiduciary

We act in your best interests — so we can make your dreams of an amazing childfree life a reality.

Zoom In:

Estate planning

Our standalone estate planning package includes three sessions, including a Childfree Wealth Checkup, with a Childfree Wealth Specialist dedicated to creating a plan for your legacy.

This package is the kickoff for your membership with our sister company, Childfree Trust, a comprehensive estate solution that provides 24/7 emergency response and professional, fiduciary POA, executor, and trustee representation.

Our Philosophy: Life Comes First. Finances Follow.

We understand what it means to be Childfree — but more importantly, we want to understand what it means for you.

Our services cover all the bases so we can provide the best possible advice:

- Life planning

- Cash-flow planning

- Investing

- Taxes

- Retirement

- Long-term care

- Estate planning

- Charitable giving

- Insurance planning

- Elder care planning

Our holistic approach means your roadmap will be as unique as you are.

Schedule your Childfree Wealth® Checkup

Hi, I’m Dr. Jay.

I’m a CERTIFIED FINANCIAL PLANNER® who’s also Childfree.

I started Childfree Wealth because millions of us are getting bad financial advice from traditional planners who don’t understand the unique circumstances and needs of people without kids.

Our team does. Want to get to know us before you introduce yourself?

Looking for more Childfree Wealth resources?

Frequently asked questions

What services does Childfree Wealth offer?

Childfree Wealth is a Registered Investment Advisor with the Securities and Exchange Commission (SEC). We are a fee-only, flat-fee, fiduciary.

We provide comprehensive life planning and financial management services including investment advice and management, tax planning, estate planning, insurance planning, cash flow and spending planning, and more.

Our Childfree Wealth Specialists, all of whom are CERTIFIED FINANCIAL PLANNERS®, are experts in life and finances, viewed through a Childfree lens.

How is Childfree Wealth different?

We’re dedicated to serving Childfree people (who don’t have kids and aren’t planning to). Because we specialize in serving this unique segment of the U.S. population (about 25%) that will never have kids, we have a unique, ongoing life and financial planning process that is tailored for Childfree people.

Why do I need an advisor?

You might not need an advisor! There are many things you could do on your own.

There is a lot of nuance and complexity to financial management, though — and plenty of instances where you might not “know what you don’t know.” For example, even with a simple investing strategy, for example, tax planning could become very complex.

It’s also not intuitive for everyone to create financial plans that align with your life goals. That’s all we do! Working with a Childfree Wealth Specialist can help you plan for both your life and finances, with the goal being to simplify your finances so that you can live an amazing life!

I already have an advisor. Why should I speak with you?

If you are happy with your advisor, that’s great! But be sure to ask them how they’re planning around the fact that you’re Childfree. If they say it isn’t any different, or that you might change your mind, you may need to change your advisor.

If they are charging you a percentage of your assets, they may also have a conflict of interest, especially if you don’t have a goal of passing on millions to the next generation. Our Childfree Wealth Specialists are experts in Childfree life and finances… Can your advisor say the same?

What’s covered in a Childfree Wealth Checkup? How much does it cost?

You’ll share with us as much information as you can, then we’ll analyze it and meet with you for an eye-opening conversation around what’s really possible in the years ahead. (What we share might just shock you!)

After your Checkup, we’ll share a detailed follow-up report and our recommendations on next steps to make your Childfree life even more amazing — including areas you can tackle yourself and those where you may want to work with a professional.

Click here to learn more about the Childfree Wealth Checkup and book yours for $250 today.

If they are charging you a percentage of your assets, they may also have a conflict of interest, especially if you don’t have a goal of passing on millions to the next generation. Our Childfree Wealth Specialists are experts in Childfree life and finances… Can your advisor say the same?

What do I get as a Childfree Wealth client? How much does it cost?

For more information, click here to visit our service tiers page.

How do I get started?

For free education around Childfree life planning and financial management, join us over at Childfree Academy!