Work With Us

Life planning and financial management through a Childfree lensStart Here: Your Childfree Wealth® Checkup

Every client relationship starts with our Childfree Wealth® Checkup, a 60-minute deep dive that’s equal parts vision board and spreadsheet.

You and one of our Childfree Wealth Specialists®, all of whom are CERTIFIED FINANCIAL PLANNERS®, will get into the dollars and cents of your financial landscape through a Childfree lens.

But you’ll also walk away with a permission slip to make unconventional choices — because when you’re Childfree, you can do that.

The Checkup is a standalone offering that will give you a roadmap to simplifying your finances, whether you hire us for more help or decide to manage them yourself.

Don't want to DIY?

Choose your service package.

After your Childfree Wealth® Checkup, your Childfree Wealth Specialist® will follow-up with recommended next steps.

Both service tiers will help you craft (and fund) the life you want to live — with varying degrees of hands-on help.

Who's It For?

What Is It?

Cost

Cash Flow & Budgeting

Investment Guidance

Basic Tax Planning

Insurance Policy Review

Directional Retirement Planning

Childfree Academy

RightCapital Planning Software

Holistiplan Tax Solutions

Advanced Estate Planning with Childfree Trust®

Advanced Tax Planning & CPA Coordination

Investment Management with Altruist

Money Mindset Coaching

Advanced Long-Term Care Strategies

Advanced Retirement Simulations

Expat Planning

Childfree Wealth® 180

(Upgrade Option)

Childfree Wealth® 360

($999/Year Value Per Person)

We work for you.

Flat-Fee

No matter your net worth, you pay a flat fee starting for our services — so there are no surprises.

Fee-only

We don’t make commissions on products or transactions — you’re the only one paying us, so we work for you.

Fiduciary

We act in your best interests — so we can make your dreams of an amazing childfree life a reality.

You’ve got a team behind you.

You shouldn’t feel trapped in your financial plan.

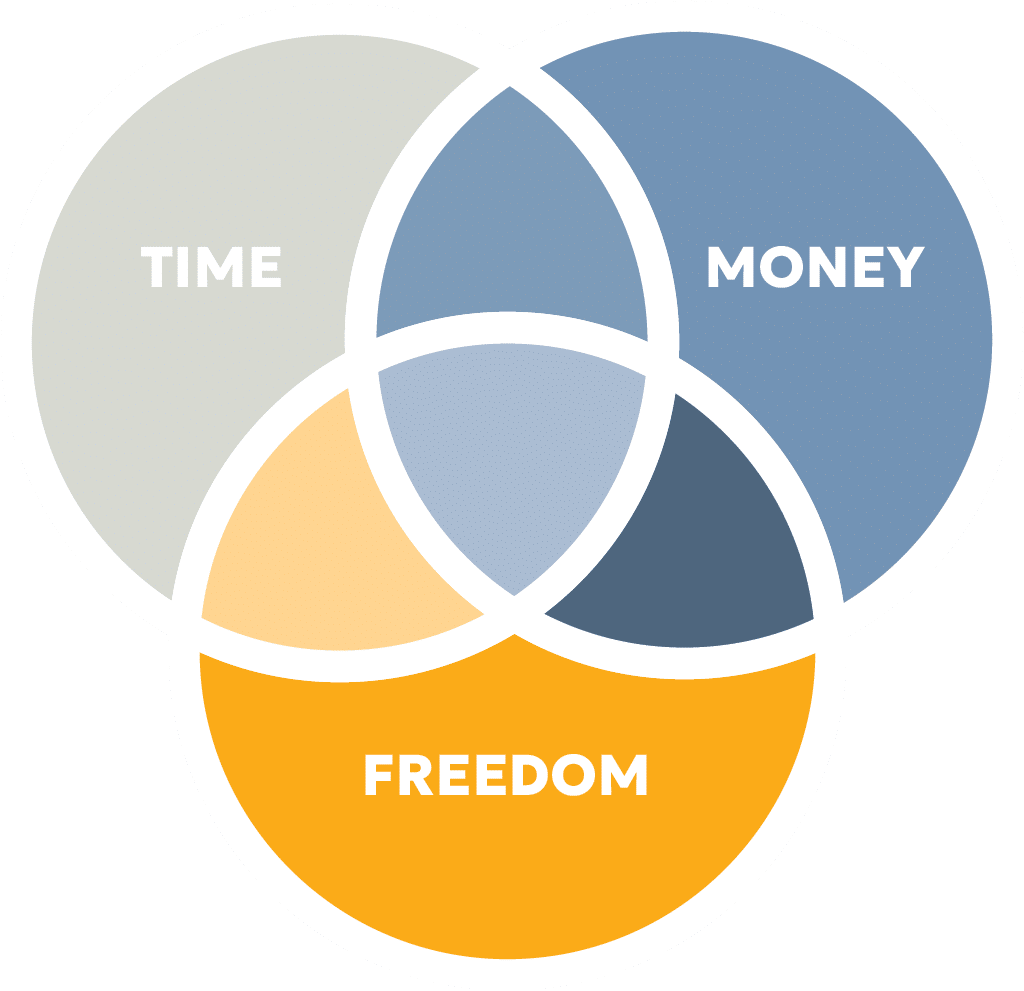

With no kids in the picture, you’ve got a lot of freedom to do what you want with your life. (And it’s a lot easier to change your plan!)

A traditional firm might hand you a massive financial plan that’s set in stone. But Childfree Wealth® is nimble enough to make adjustments on the fly as your plans change — because we view your life and finances through a unique childfree lens.

Help when you need us

A plan for now and the future

Enjoy your life today and ensure you have a plan to care for your and your loved ones later.

Tailored to your dreams

Your life is dynamic. We’re ready for the ride.

Frequently asked questions

What is included in the Childfree Wealth® 360 package?

We offer concierge-level service and can help you coordinate or even facilitate communication with other financial professionals.

Finally, you’ll also have access to our financial planning software, RightCapital, and membership in our academy with hundreds of videos and resources to answer your questions.

Can you help me plan care for myself and loved ones?

This type of planning is included in our 360 service to help you create a care plan for loved ones and yourself, including:

- Long-term care

- Estate planning

- Charitable giving

- Elder care planning

Childfree Wealth® 180 clients can upgrade their service to our Estate Planning Package for more comprehensive advice and planning for the long term.

We also offer Childfree Trust®, a nationwide solution that provides medical and financial POA, executor, and trustee representation for Childfree and Permanently Childless people.

Ask your Childfree Wealth Specialist® for more details.

What’s a Childfree Wealth Specialist®?

How often will I meet with my Childfree Wealth Specialist®?

For 180 clients, you’ll meet with your Childfree Wealth Specialist® quarterly.

I want to cancel my service. Can I get a refund?

Short answer: We don’t offer refunds, but you can cancel your service.

Childfree Wealth® 180: You can cancel your service with 15 days’ notice. There are no refunds within the quarter you have already paid for.

Childfree Wealth® 360: There’s a six-month minimum commitment for the 360 service. After six months, you can cancel your service with 15 days’ notice. There are no refunds within the quarter you have already paid for.

What does “Childfree” really mean?

If you don’t have kids and never will, you’re Childfree — and we’re here for you. You’re not Childfree if you…

❌ Don’t have kids yet but plan to

❌ Have kids in college

❌ Are empty nesters

Couldn’t I do all this myself?

Some of our clients have had success doing it themselves. Others have found it intimidating and time consuming after some time and joined us as ongoing clients. Your experience may vary.