RESOURCES

Useful Articlesand Resources

The time to plan for a disability is NOW

By Jay Zigmont | Aug 28, 2022

Over 1/3rd of Americans over the age of 55 are disabled. Although disability can take many forms, the ultimate result is a loss of both income and the ability to do the things we enjoy. Often disabilities are sudden (injury, heart attack, stroke, and others) so we need to be prepared well in advance. Being […]

Read More

There is a Difference Between Childfree and Childless Financial Planning

By Jay Zigmont | Aug 28, 2022

There is a bigger difference between Childfree and Childless than just a definition. When it comes to financial planning your plan may be similar, but the differences matter. The US Census defines Childless as not having biological children (12.8% of Childless older adults have adopted or stepchildren), while Childfree is defined as not having and not planning […]

Read More

FILE vs FIRE – Finding what is right for you.

By Jay Zigmont | Aug 28, 2022

It used to be that the goal was to retire and ‘get the watch.’ People would work 25 years at one company, pay their bills, and then retire (often with a pension). Those days are gone. Retirement is no longer ‘guaranteed’ for anyone and may not even be a choice for many. Even for those […]

Read More

Debt is stealing from your future.

By Jay Zigmont | Aug 28, 2022

For most Americans, debt has just become part of life. It is almost like we are born with it. At 18 we enter college, sign on for student loans, and there are stands everywhere offering free gifts if we sign up for a credit card. Then we ‘need’ a new car, get a car loan, […]

Read More

The Gardener and the Rose

By Jay Zigmont | Aug 28, 2022

Being a Childfree couple allows you to have different options in life. You get to choose how you want to live your life. The only thing you truly must worry about is yourself and your partner. The problem is that it can be difficult for both you and your partner to achieve your dreams, especially […]

Read More

Creating Successful Small Businesses and Side-Gigs

By Jay Zigmont | Aug 28, 2022

With today’s hustle culture combined with a search for meaning, many people are following their dreams to start a small business. Being Childfree often allows us the time, money, and freedom to stretch and see what is possible. If you decide to start a small business or other side-gig, you need to make a series of […]

Read More

How does your financial planning change if you are single, in a couple, or in a group?

By Jay Zigmont | Aug 28, 2022

By nature, Childfree individuals seem to be more flexible in their family structure. In Childless individuals over 55, 32.1% were never married (as opposed to 2.6% for parents). Childfree individuals are more likely to stay single, be in a long-term relationship (without being married), and to be in a group than the general population. Your choice […]

Read More

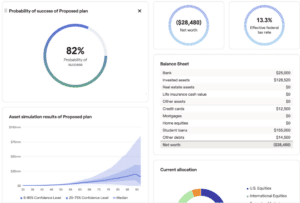

Am I spending too much or saving too much?

By Jay Zigmont | Aug 28, 2022

The internet is full of general rules and numbers that say you are either doing ‘good’ or ‘bad’ with your finances. In reality, the only measure of success that matters is if you are on the path to your goals or not. With that said, I often find that clients fall into one of two […]

Read More

Investing 101

By Jay Zigmont | Aug 28, 2022

Investing is not hard, but it is important. The key is to follow the rule that “You only invest in things you understand.” The rule applies no matter how much experience you have in investing. Understanding an investment includes: Why you are buying it (the impact on your financial plan) Where to buy it (which […]

Read More

5 questions to ask yourself before buying a house

By Jay Zigmont | Aug 28, 2022

The classic advice is that the way to wealth is built around home ownership. This advice is part of the standard script of what is expected. What about if you are living a Childfree lifestyle? Childfree people have more time, money, and flexibility to do what they want. The bottom line is that for us, home […]

Read More