RESOURCES

Useful Articlesand Resources

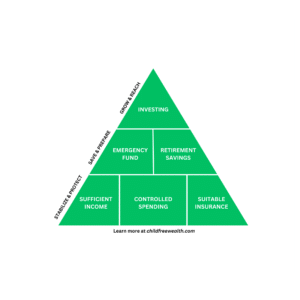

Using the Financial Planning Pyramid to Grow… or to Just Get Started!

By Jay Zigmont | Mar 21, 2023

When I began to get serious about my personal finances, I didn’t know where to even begin. I’d heard people talk about how important it was to have a budget, and I also heard people talking about 401ks, and I was told my student loans really needed to be paid off ASAP, and, oh, I […]

Read More

Should I Set Up a Roth IRA?

By Childfree Wealth® team | Feb 1, 2023

A Roth IRA is a type of investment account that you don’t ever pay taxes on once you’ve put money into it. As with anything, there are exceptions to the rule, but the Roth IRA can be an extremely powerful tool when it comes to your finances. You might be thinking that if it is such a […]

Read More

Can I Take a Loan From My 401(K)? (and should I?)

By Childfree Wealth® team | Jan 28, 2023

For those who want the quick answer: Yes, 401K loans exist with many (maybe even most?) plans! That said, there are lots of rules and pitfalls in taking 401K loans so read further for more information. 401Ks have numerous features that may come in handy, particularly as a last resort. Features such as being able to […]

Read More

Childfree Retirement

By Childfree Wealth® team | Jan 26, 2023

In my 10+ years of being a financial planner, the most exciting aspect of this job is helping people do something they never thought they could do. This is particularly rewarding when working with Childfree people and they have the realization that all the “traditional rules” of life are thrown out when you don’t have […]

Read More

How Much Do I Need to Retire?

By Childfree Wealth® team | Jan 25, 2023

“How much do I need to retire?” may be one of the most commonly asked questions among those turning their eyes toward retirement. I vividly remember the ING campaign from 2008 that catered to this common question with the “What’s your number?” advertisements that suggested something as complex as retirement planning could be summed up […]

Read More

Should I Rollover my 401K?

By Childfree Wealth® team | Jan 24, 2023

I remember what I thought was a very clever, tongue-in-cheek statement on the wall of a restaurant. This seafood restaurant, in mural-sized font, had “Free Crab Legs Tomorrow” painted in the style of a fresco. I find that same statement to ring true for people who have just left a job and now have some […]

Read More

What is Inflation and How Does It Work?

By Childfree Wealth® team | Jan 23, 2023

If you’re here for the easy answer then inflation is the increase in price over time for the same item. Keep reading if you want a glimpse inside the more complex workings of inflation. Background Information Ah, inflation. The thief in the night that slowly drains the purchasing power of your money. It’s an overlooked threat […]

Read More

What is a Recession and What Do I Need to Do About It?

By Childfree Wealth® team | Jan 23, 2023

You’ve probably heard the term “recession” thrown around quite a bit when politicians, businesspeople, or other prominent figured talk about the economy. It’s an amoebic term that doesn’t have an easily measurable definition, but many people know it to mean the economy isn’t healthy. Most people familiar with recessions consider two consecutive quarters of reduced […]

Read More

Opportunity Costs and Die With Zero

By Childfree Wealth® team | Jan 4, 2023

I was somewhere between Washington DC and Seattle when the concept of opportunity costs smacked me in the face (versus the more subtle way it typically appears in my life on a daily basis – sneaking into my decision-making on a just-barely-conscious level). I was sitting in an aisle seat of a Boeing jet, headed […]

Read More

Year-end look back – start next year on the right foot.

By Jay Zigmont | Dec 23, 2022

At the end of each year, we need to look back and forward. We need to look back to understand what worked and what didn’t, while we need to look forward to understand what we can do differently for next year. The goal isn’t to beat ourselves up for the past year but to understand […]

Read More